Latest Articles

-

Knowing How to Find A Cash Loan Service That Meets your needs

If you’re in search of an money loan with more than just a basic interest rate, you must be cautious.Certain companies offering high interest rates have large upfront fees and some don’t make any of the money back they’re charging.

In the majority of cases companies will charge the cost of their services. If you repay them in time, they’ll offer you additional loans to meet your requirements.However, should they not get their repayments, there’s the possibility that they will not get the money back in any way.

When choosing a lender for money

Make sure to do your homework so that you are sure that you are getting the most efficient loan amount you’re entitled to.Keep in mind that the rate at which you pay might not exactly the same the one paid by other firms.

It is also important to know that there are a lot of businesses that offer zero or low interest rates on loans, but the rates are higher than the rates offered by other.Of course, the higher interest rate is likely to be due to the fact that the firm charges a substantial cost to provide you with cash.

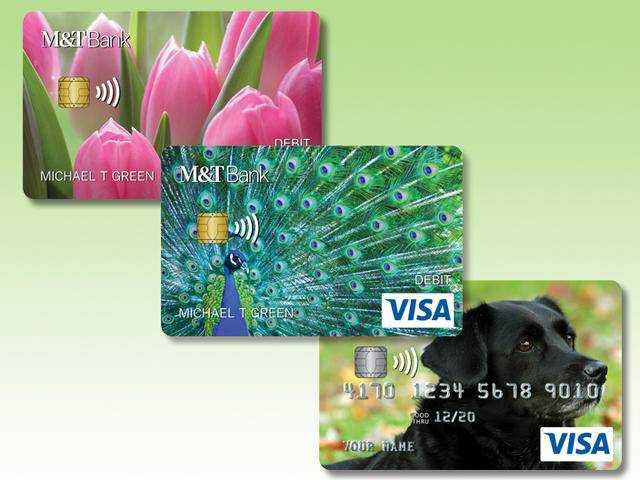

If you are looking for a reliable cash loan it is crucial to be aware of what you need before you pick a.For instance, some of the requirements that are common include the need for a checking account, debit card or an EBT card or a Social Security number.

If you don’t satisfy these criteria, then you could be denied on a loan since the company doesn’t know whether you’ll be able to pay the repayments or not.But, the application process for a loan via https://www.paydaychampion.com/ is usually quite brief and easy, so there’s no reason to be concerned over making an error while making the application.

Meet the criteria to be eligible for a loan

Check their terms and conditions and fully understand the terms you’re agreeing to.A lot of the conditions and terms are pretty simple, for example, minimum monthly payments, and interest rates.

Remember that there could be firms that offer the same service, however, they charge a minimal cost to provide their service.The company offering the money loan may charge additional fees to get you through the door, and also to keep you as a client.

If you discover the loan you want to take that appears like a great idea however, it doesn’t meet your needs, then you could be better off looking for a different company to deal with.It could be beneficial to locate a cash-advance loan business that doesn’t require any type of request form or credit check.

Debt consolidation loans

There are a variety of firms that offer debt consolidation loans and don’t require any kind of credit check.This kind of loan is a lot more sought-after because it is precisely what it is: the debt consolidation loan.

These loans usually comprise only one payment, instead of many installments for a variety of loans.They are referred to as non-profit organizations that aim to help individuals manage their debt.

Once you know the requirements to know, finding a loan that is suited to your requirements is a breeze.You just need to review the criteria you require, and you’ll be able to get the loan you need in a matter of minutes.